Just another in an on-going series of “rich bastards figuring out that there’s no more money to take.”

Wait until they pay off the politicians to allow debtors prisons and indentured servitude.

I hope… No, I pray that Klarna, Afterpay and all the other similarly shitty services go belly up. They’re basically modern payday lenders and those businesses should die.

You know a lot of those cash advance apps you can just revoke the ACH and delete your card from it. In their terms of service it literally says you are not obligated to pay it back. All those fintech companies.

I don’t use them myself but I’d imagine most users aren’t aware of that loophole or are worried about their credit score.

It can’t affect your credit score, because it’s not a loan.

If it was a loan they would be subject to ursery laws. But they don’t want to be. So you can default without penalty besides being hounded.

Tell me more of this dark magic!! Please!!!

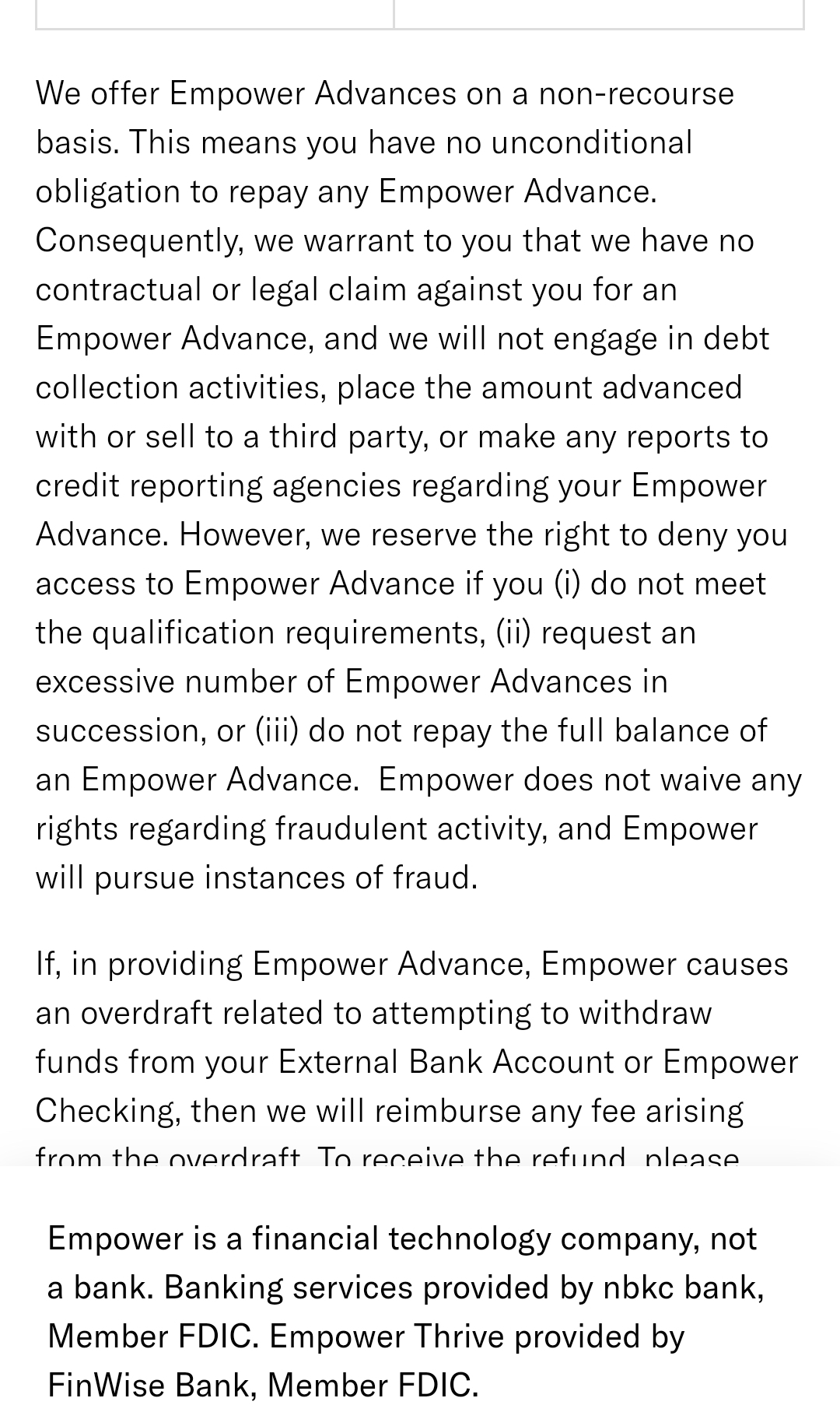

Example, this one is for Empower…

I’m not a lawyer or endorsing any of the activities but it spells it out in their terms you’re not obligated to pay it back.

Wow … Wait what… What am I doing with my life?

Creditor would still seek remedy I would presume

Fuck that guy tho can’t get blood from a rock folks.

It was on Reddit awhile back… https://www.reddit.com/r/UnethicalLifeProTips/comments/rizto7/ulpt_never_repay_an_advance_app_back_there_is_no/

I checked it out. That’s three years old.

I don’t think these apps actually are the creditor. They are “platform” they don’t care if yoindont pay. Creditor would.

It is debt. Defaulting on debt carries risk, people should be aware of it. Strategic default is that just that strategic.

If you are going to do it, either seek advice proper counsel or do your own research.

It is a valid tactic but people need to be aware of risks.

I may or may not know somebody that revoked ACH and closed accounts with a few of them a year ago and nothing ever came of it. They’re fintech companies not banks.

Do payday lenders (like Money Mart or whatever) not charge fees unless someone is late on a payment? I honestly don’t know how they work. I was under the impression that similarly, the only way Klarna and the others made money was by late payment fees since whenever they come up in a checkout it always says there are no fees (which I take to mean if payments are on time).

The truth is SO MUCH WORSE than that. (Last Week Tonight segment on it) TL:DW - all of the initial payments only go to the insane interest they are already planning to charge you, then when you’ve paid back the amount of the original loan (all as interest, so not even denting the principal yet), then they jack up the cost even more. Scum.

Thanks, that sounds more like what I thought I heard about them before (though I think there’s a touch more regulation in Canada, even here I know it’s still predatory and should be avoided).

But the economy is doing great, we promise

Numbers may not lie but whoever massages them does.

I guess I am a statistic then. Our family couldn’t do it anymore and it got out of control. We gave up all the cards and did debt consolidation… it’s going to be a fun 5 years, if we can even make this work.

I think we all saw this coming the second it was possible to finance a pizza.

If I knew how much time I had left, I would 100% apply for all the cards and predatory loans I could, them max them out with no intention of repaying a cent.

Make sure to also get rid of all your money and possessions before it happens so they cannot claim a single cent from your estate.

Oh absolutely. If Trump wins, I’m withdrawing every penny from all my accounts. Not sure what to do after, but I’ll do my part to fuck the financial system, since that’s all they care about.

Its not just honest defaulting they have to deal with. What most people aren’t made aware of is that when banks etc. lend money to people, the bank creates that money right there and then. Just like typing it into an excel sheet and pressing enter. Through this, private banks create 80% of the money in our system: not the national bank who make the rest which includes all the physical money.

Essentially, we’ve given private banks the licence to print our money and no one seems to think that there might be a problem with that idea.

So, much like the financial crash, there’s no reason not to suspect this is going to have a huge element of banks just creating loads of money for themselves to use.

Those that aren’t unable to pay off loans are running out of money too but aren’t taking out new loans to buy new things. So, there’s no new credit lines being made, in which these things can be lost, a bit like in a ponzi scheme but in reverse. Its also one of the reasons inflation (too much money chasing too few things) is so high. Covid was the perfect time to do it, due to all the loans being issued (money being created). You don’t hide a needle in a haystack. You hide it in a giant pile of needles.

Paying back to loans and paying tax actaullt destroys money too. So, another reason we have too much money is not taxing the rich fairly but tbats another story. Governments create money and then takes tax. What isn’t destroyed is the deficit.