Guide to saving money:

Start a legal battle with the federal government.

Government: “LOL”. Jail.

Tax evasion?

Believe it or not, straight to jail.

Unless you’re rich

The only way they were able to arrest Al Capone was on tax evasion.

And Wesley Snipes!

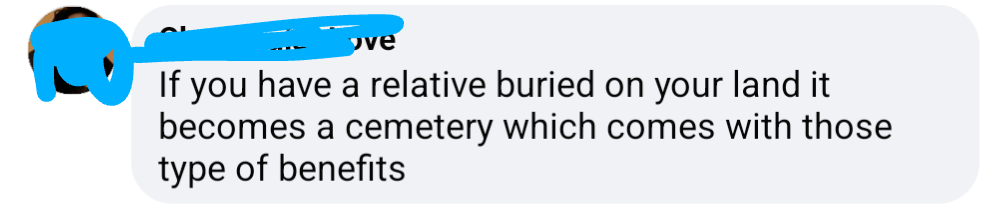

Another sovcit has a wonderful answer today.

Nowhere does it state that the relative can’t be killed by you, or that there relative has to be dead in the first place. Very convenient. This should be an open and shut case (the STATE will lose)

I really hope they don’t try to do this themselves.

Fun part: Ask them to point to examples of such cases where the state lost in federal court.

Maybe I will, for the lolz.

Do your own research lazy bones

That would work with someone who argues fairly. But with someone, who has the super weapon of “they don’t want you to know, so they hide those cases”, you won’t get far.

I can’t find it right now, the government censored my Google.

New answer today:

Obviously. Duh.

“Educate the tax assessor” I’m screaming.

The tax assessor already has a migraine.

‘How does one make their property “private”?’ As opposed to public, as it seems to be now? Dude, you’re paying taxes because your property is private.

Aren’t they lovably crazy?

They apparently mean private as in invisible to the legal system and not a part of any public records. Not sure what property has ever worked like that for them to be basing such an idea off of.

The Vatican maybe?

So you are saying that l just need to make my 1/4 lot with a 100 year old two story an independent country? Sounds good to me. Hopefully I can get Swiss too.

One of their answers.

Don’t want to pay property taxes? Ok here’s all the services you won’t get or be able to use. If you do try, we’ll arrest you.

I’m waiting for the list…

Maybe we should list all the services that they do get.

It’s definitely not waste, water, sewer, electricity hookups, or even a certificate of habitability, which the mortgage company would want. Also no police, fire, or access to schools, parks, sidewalks, street plowing/sweeping, tow services for cars parked across your driveway, heck, the city would be okay with removing the driveway access to the road.

I think what you’d get for free is very annoyed neighbors.

They also don’t actually get any property, because the state isn’t enforcing any property rights

water, sewer, electricity hookups

These are, in many parts of the US, provided by utility companies and not exactly funded by property tax.

This is true. Unfortunately, some of those require permits to set up, or if set up, payment in dollars, not forms.

There are a lot of people who don’t pay properly tax and get all of those services, for example, people who rent.

You still pay income tax and sales tax.

Renters pay the owner’s property tax.

Ok, so then the owner isn’t paying property tax.

In reality, the renter is not actually paying the property tax. They may be paying for it, but they are not the one paying the bill at the end of the year.

Edit: classic lemmy. The renter may be giving money to the landlord which covers the cost of the tax, however that is irrelevant. a renter by definition, does not own the property and therefore does not pay property taxes and yet, still is able to utilize public infrastructure. Just like how a person who doesn’t have income is still able to use public infrastructure. Your ability to pay into the system does not preclude you from participating.

Sounds good, bruh.

Step 1: Sell your property Step 2: Live on the street where there is no property taxes

Has any of this weird, idiot sovcit crap ever worked?

Nope!

I think at one time in Nevada (or possibly still) you can get allodial title to property. You don’t have to pay taxes on that. However in practice you’re simply pre-paying property taxes for a certain amount of time.

IANAL, but I recall this being a thing in a few states.

At first I read these and laughed, now I just feel sad.

FYI there’s a eighties movie where a guy does this, gov shows up. Huge standoff.

Forget the ending and name though :(

Call me when you have your day in court. I enjoy watching morons become befuddled.

MF, i rent intentionally to avoid surprise roof bills and the like, and I still pay my property taxes as part of that. It’s built in, neither owner nor manager is taking it on as a cost of doing biz.

Personally, because I WFH for a giant company, it matters not whether I live in RI or LA. It matters a great deal to me, however, and covering that expense monthly beats hell out of paying annually.

If I can calculate why that makes sense to/for us and our lifestyle, so can these loons.

I absolutely know that one way or another, it will get billed to me. But by not owning, I’ve the privilege of paying it as I prefer and literally (and legally) making the property taxes someone else’s problem.

I don’t have to care, I just pay what I said I’d pay, and if things change and we need to up stakes for whatever (likely political) reason, I can do it without screwing around with house showings and RE agents.

Conscious choice to simplify future bills and problems > blowing it off with bullshit.

Would be funny if there were still some old laws which would let new settlers just legally claim that plot from these “natives” after getting it off the records.

This got me curious if one could buy land in some remote unicorporated area to avoid any tax jurisdictions, but it seems that there would at the very least be county level taxes.