In 2008, as the-then B.C. Liberal government was poised to bring in Canada’s first carbon tax, the B.C. NDP staunchly opposed it, saying a climate plan should not tax consumers but target major industrial producers such as the gas, oil, cement and aluminum industries.

Yeah, I am talking in macro scale. The things as consumer can choose to avoid:

But as consumer I can’t avoid:

The important part is, where the carbon tax go? Do they go into hands that actually have goals and plan/milestone to meet? Or they go into some paper green RnD subsidiaries of big oil?

https://www.canada.ca/en/environment-climate-change/services/climate-change/pricing-pollution-how-it-will-work/putting-price-on-carbon-pollution.html

Consumers also have a choice not to support companies as they see fit. Shopping locally sourced goods goes a very long way.

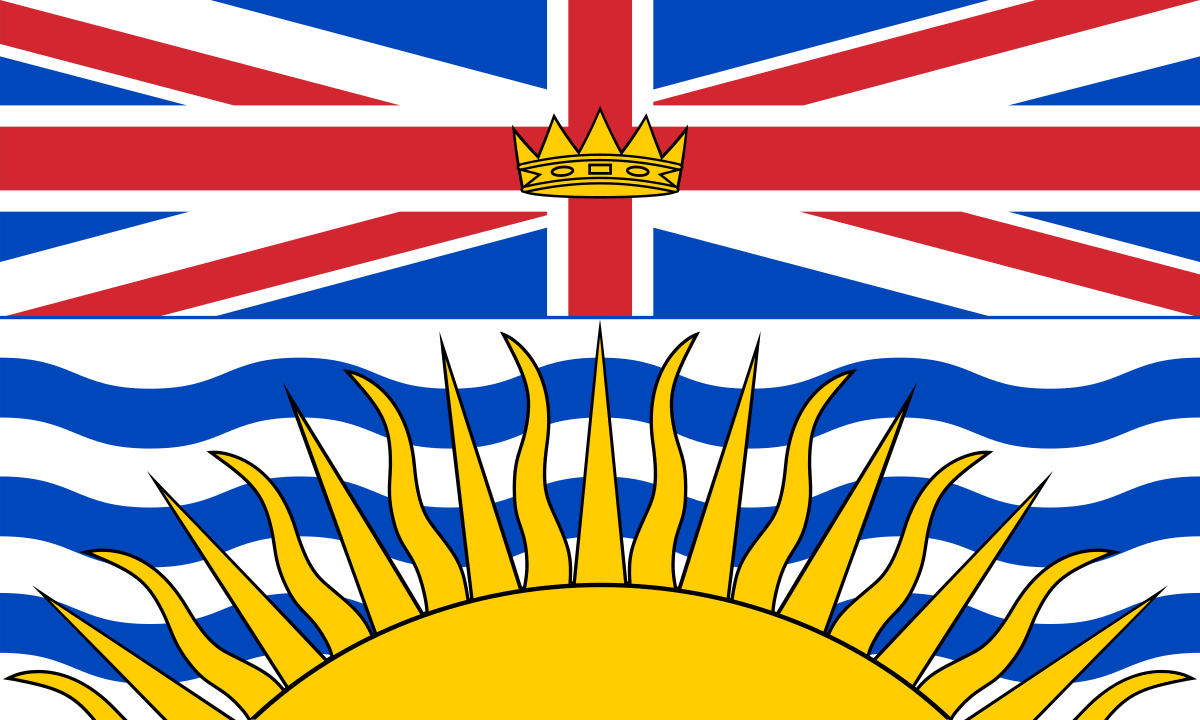

We have our own carbon tax in BC, it has nothing to do with the federal government.

I am aware.

It goes back to province and then where? If it benefits everyone, say upgrade the library to be more energy efficient, provide rebates if you upgrade your heat/aircon system to modern standard of your buildings, like those I’d say that’s good use of carbon tax money. But if dumped to some big oil RnD branch for green energy tech that we won’t see in another 10/20 years, cause they do not have any motivation to actually pull it. (since their balance sheet is neutral once they get the tax money back from one of their branch/subsidiary. ) I might be biased cause I lived in a old tower building, I really wish our building can start the window/etc remodeling but I only have 1 vote. (my winter base board heating is 200+ on coldest weeks, cause the entire building’s windows are over 25+ years old and already leaking and not up to par. )

I do wish there are more locally own/operated grocery stores or farmer’s markets. But they are usually located at the out skirts of the city and then you have to drive to get them. The web operated aren’t exactly benefiting those farmers nor consumers nor the carbon goals and more expensive/less choice. (because quantity and delivery vehicles etc. )

You are literally communicating to me on a device that could answer your question. I also provided you a link with more information.

I am not going to hand hold this conversation for you when all you are doing is speculating.